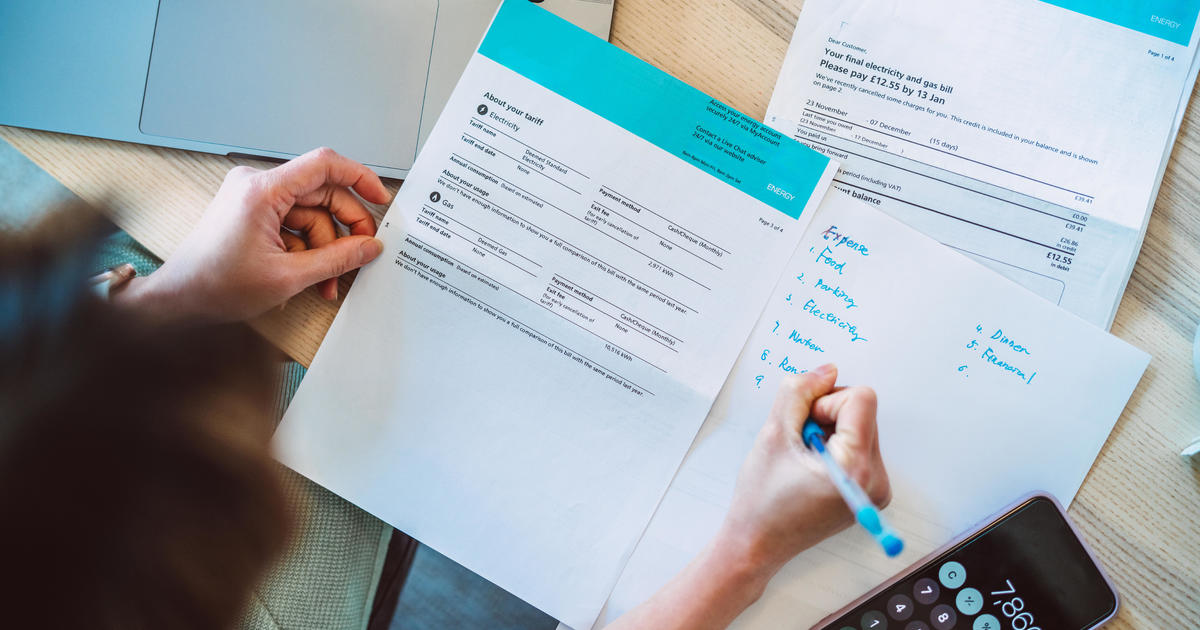

Living “paycheck to paycheck” is a phrase often used to describe households that are under financial strain. But what does it really mean, and how many people find themselves depleting their paychecks shortly after earning them?

Bank of America Institute defines living paycheck to paycheck as a households “where necessity spending is more than 95% of their household income, leaving them relatively little left over for ‘nice to have’ discretionary spending or saving.”

Many of these spending pressures are likely unavoidable, as they relate to family and housing costs,” Bank of America Institute senior economist David Tinsley told CBS MoneyWatch.

In a Bank of America Institute survey of consumers in the third quarter of 2024, roughly half said they considered themselves to be living paycheck to paycheck.

Also analyzing its own customer spending patterns, the financial research firm determined that close to one-quarter of Americans actually live paycheck to paycheck, with most of their monthly income going straight toward essentials.

The share of households that are living paycheck to paycheck has been rising slightly over the last few years, which is not terribly surprising, because prices have risen for a lot of essential goods — groceries are more expensive, the cost of car insurance is up, and child care is up, too,” Tinsley said.

A majority of Americans say they feel worse off than four years ago, according to Gallup. And 6 in 10 voters describe the U.S. economy as either “fairly bad” or “very bad,” according to CBS News polling.

Higher income, higher housing costs

While lower-income households have a higher share of people who live paycheck to paycheck, some families that are higher up on the income ladder also fall into the same category.

Around 35% of households with incomes below $50,000 a year are living paycheck to paycheck, up from 32% in 2019, according to internal Bank of America data. Meanwhile, about 20% of households earning $150,000 are living paycheck to paycheck, according to Bank of America Institute’s findings. That’s largely because they have high, fixed housing costs, according to Tinsley.

“People with higher incomes tend to have high-priced homes, and many will have large monthly mortgage payments. So it’s perfectly possible someone with a high income could have a lot of it swallowed up by essentials,” he said.

It’s financially straining to live paycheck to paycheck. “It’s usually thought of as a bad thing that adds stress and is detrimental to a person’s sense of financial well-being,” Tinsley said.

It’s also a hard cycle to break out of. Housing costs, which are often a household’s greatest expense, can be hard to minimize.

For most people, they can’t do much about where they live and how much they pay for their home, if they have kids at a school in a particular neighborhood,” Tinsley said. “A lot of these costs are sticky, and there isn’t much to do about it.”

In the long-term, such households end up with little in savings and are exposed to financial shocks.

If there were another inflation shock, or a sharper downturn to economy than expected and some people lose jobs, then people living paycheck to paycheck are most immediately pressured to make sharp reductions in spending to balance the books,” Tinsley said. “And that impacts the overall economy.”